In a surprising twist for financial education enthusiasts and mobile gamers alike, Monopoly GO has emerged as the unexpected financial literacy tool of 2025 through its growing presence on TikTok's #moneytok community. The digital adaptation of the classic board game has transcended its entertainment roots to become a genuine platform for teaching money management principles to a generation struggling with personal finance knowledge.

"It's like the classroom I never had," says 24-year-old Taylor Martinez, who credits Monopoly GO moneytok videos with teaching her budgeting skills that her high school economics class never covered. "Who knew rolling digital dice could actually help me understand investment strategies?"

The Unexpected Financial Educator

The fusion of Monopoly GO and the moneytok hashtag has created a unique digital ecosystem where financial concepts are presented in an accessible, gamified format. Financial experts like Abigail Rose Foster, author of the bestselling book "The Money Manual" and a prominent figure in personal finance education with over 200,000 followers across platforms, have taken notice of this phenomenon.

"There's a mad obsession with people understanding their own personal finances these days, and Monopoly GO moneytok content is meeting them where they are," Foster noted during a recent Rebel Book Club interview. "The game breaks down complex concepts into language people understand, avoiding the jargon that intimidates so many."

Unlike traditional financial education that often promises unrealistic 10% stock market returns, Monopoly GO moneytok content tends to emphasize strategic thinking, risk management, and the importance of diversification – lessons that resonate in today's volatile economic climate.

Beyond Entertainment: Real-World Applications

What makes Monopoly GO moneytok particularly valuable is how players are drawing parallels between in-game strategies and real-world financial decisions. The community has developed its own vernacular, blending gaming terminology with financial concepts:

-

"Property stacking" – a technique for building investment portfolios

-

"Chance card readiness" – preparing for unexpected financial emergencies

-

"Passing GO bonuses" – maximizing passive income streams

"I'm not gonna lie, I was flat broke before I started watching these videos," admits Carlos Washington, a college student who discovered Monopoly GO moneytok six months ago. "Now I've got an emergency fund and I'm actually thinking about my financial future. That's straight-up crazy to me."

The Cultural Impact

The Monopoly Man himself has become an unlikely financial guru for Gen Z and younger Millennials. His iconic top hat and mustache appear in countless moneytok videos, often modified with contemporary financial accessories like cryptocurrency symbols or investment charts.

"The Monopoly Man represents old-school financial wisdom with a modern twist," explains digital culture analyst Dr. Samantha Reeves. "He's the perfect mascot for this movement – recognizable, non-threatening, but still associated with wealth and financial success."

Addressing the Critics

Not everyone is sold on the educational value of Monopoly GO moneytok. Some financial professionals worry that the gamification of money management could lead to unrealistic expectations or oversimplification of complex topics.

"Look, I'm all for making financial education more accessible," says certified financial planner Marcus Johnson. "But we need to be careful about equating game mechanics with real-world finance. In Monopoly GO, bankruptcy is just a reset button. In real life, it's devastating."

Despite these concerns, the Monopoly GO moneytok community continues to grow, with videos regularly receiving millions of views and spawning dedicated discussion groups where members share both game strategies and personal finance tips.

The Future of Financial Education

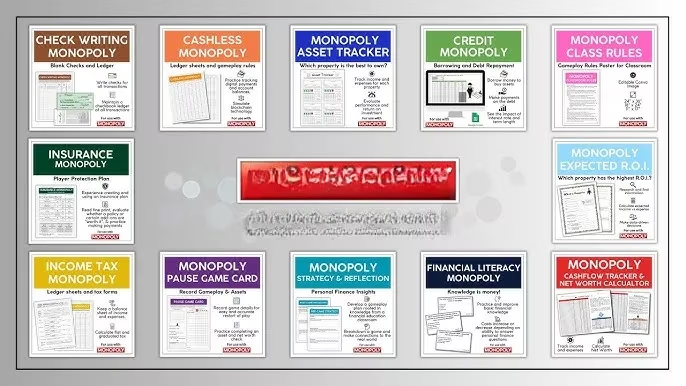

As we move deeper into 2025, the intersection of gaming and financial education appears to be more than just a passing trend. Educational institutions are taking notice, with some forward-thinking high schools and colleges even incorporating elements of Monopoly GO into their financial literacy programs.

"The kids are absolutely eating it up," reports high school economics teacher Vanessa Rodriguez. "When I reference Monopoly GO concepts in class, I suddenly have everyone's attention. It's a total game-changer for teaching personal finance."

Whether this fusion of entertainment and education represents the future of financial literacy remains to be seen, but one thing is clear: Monopoly GO moneytok has changed the conversation around personal finance, making it more accessible and engaging for a generation that desperately needs these skills.

As one viral TikTok creator put it: "Your grandparents learned money from playing actual Monopoly around the kitchen table. Now we're learning it from Monopoly GO on our phones. Same lessons, different board." And in a world where financial education is increasingly crucial but often overlooked, that might just be a winning roll of the dice.